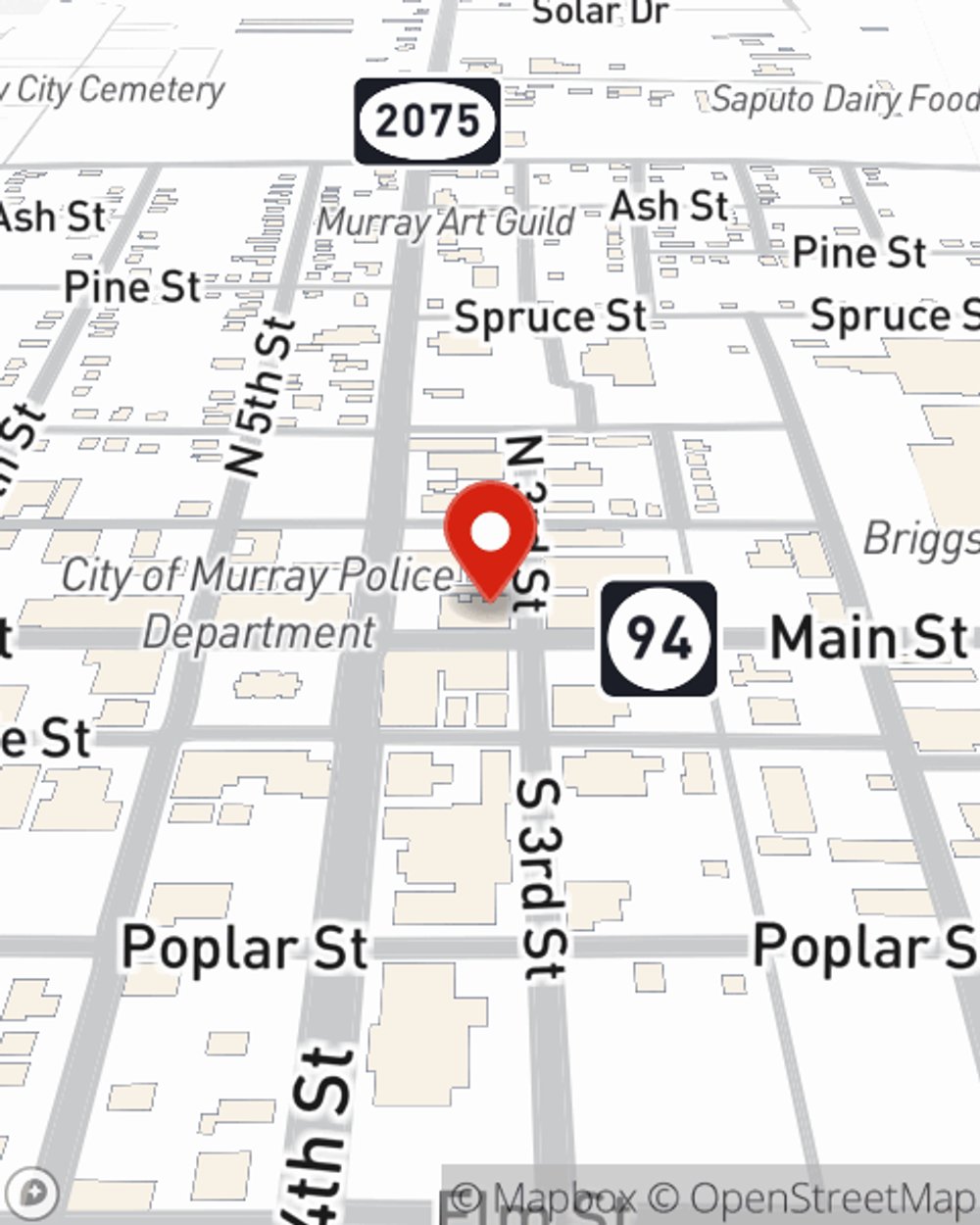

Auto Insurance in and around Murray

Looking for great auto insurance around the Murray area?

All roads lead to State Farm

Would you like to create a personalized auto quote?

Your Auto Insurance Search Is Over

Whether it's a scooter or an SUV, your vehicle could need great coverage for the necessary work it contributes to keep you moving. And especially when the unpredictable happens, it can be important to have the right insurance for this significant aspect of your daily living.

Looking for great auto insurance around the Murray area?

All roads lead to State Farm

Get Auto Coverage You Can Trust

The right deductibles may look different for everyone, but the provider can be the same. From collision coverage and emergency road service coverage to savings like an anti-theft discount and accident-free driving record savings, State Farm really shifts these options into gear.

State Farm agent Ryan Walker is here to help break down all of the options in further detail and work with you to design a policy that is right for you. Contact Ryan Walker's office today to discover more.

Have More Questions About Auto Insurance?

Call Ryan at (270) 753-9935 or visit our FAQ page.

Simple Insights®

How to use vehicle safety ratings to help you purchase a car

How to use vehicle safety ratings to help you purchase a car

Crash test ratings and other vehicle information can help you make an informed new or used vehicle purchase.

Reasons to consider retirement planning for high school students

Reasons to consider retirement planning for high school students

Money management for high school students can lead to a lifelong saving habit. See how planning for retirement savings can improve financial security.

Ryan Walker

State Farm® Insurance AgentSimple Insights®

How to use vehicle safety ratings to help you purchase a car

How to use vehicle safety ratings to help you purchase a car

Crash test ratings and other vehicle information can help you make an informed new or used vehicle purchase.

Reasons to consider retirement planning for high school students

Reasons to consider retirement planning for high school students

Money management for high school students can lead to a lifelong saving habit. See how planning for retirement savings can improve financial security.